A pitch deck, or a presentation introducing a startup, is usually the first opportunity for founders to present their idea to investors. Its aim is to convince them that out of hundreds, sometimes thousands of projects landing in their inboxes, yours is the one worth supporting. It can therefore decide the fate of the startup. No wonder that the question of what and how to write (and also what not to write) in a pitch deck often keeps founders awake at night.

There is no single correct template for a pitch deck. However, there are several basic elements that should not be omitted in the deck and several that significantly increase the chances of successfully attracting investors’ attention.

Pitch deck: what is it?

A pitch deck, or investor presentation, is a business card of a startup seeking financing. In this document, founders share their company vision with investors, who expect to find specific data about the product, team, and future plans. Importantly, a pitch deck should not be long – investors review many such presentations, so the time they can devote to one deck is limited. The ideal length? Ten to twelve pages in volume.

So how do you make a good impression having only a few slides? Apply the same strategy as when designing a product – deliver material that is as tailored to needs and expectations as possible.

What information do investors look for in a pitch deck?

1. Executive summary

The executive summary is a brief overview of the project at the beginning of the presentation. Many founders skip it, believing that the presentation is like a good story, and writing a summary at the beginning gives away its ending. However, when the project is complex, a well-written executive summary facilitates understanding of subsequent chapters of this story. It’s crucial that it be concise and easily digestible – then it will fulfill its role well.

2. Problem + solution

Have you ever heard the saying: “sell the problem and you won’t have to sell the solution”? This is often the case – properly describing and identifying the problem can be more important than the solution itself. The product may go through various iterations, but if it solves a real problem for a sufficiently large group of recipients, in the eyes of investors it is (almost) destined for success. When describing the problem, try to do it in a way that your audience can actually imagine it and start pondering over the solution themselves.

Let’s see how Airbnb handled this challenge?

It’s worth adding that Airbnb’s pitch deck is considered by many to be one of the best investor presentations ever created.

3. Product/solution description

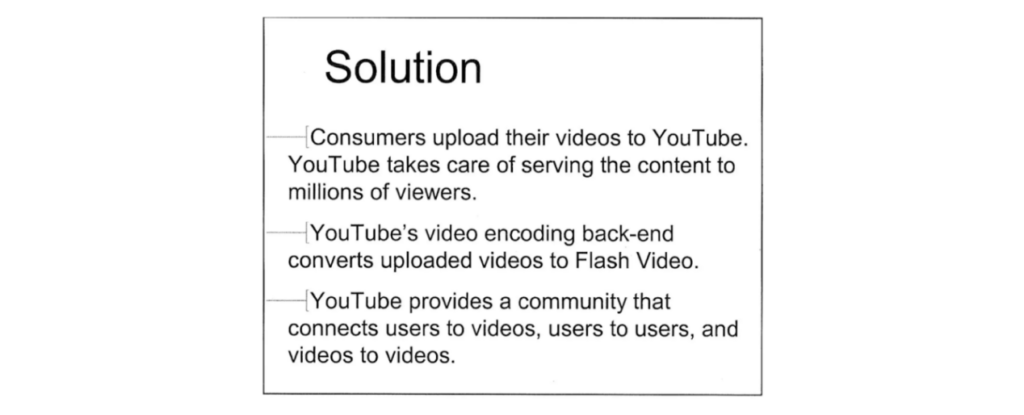

Obvious? Yes. However, the key is how it’s formulated. New or innovative solutions are often complex, and investors don’t necessarily have to be experts in the area the product concerns. So pay attention to describing what the product is about in a simple, easily digestible way. Don’t delve too much into technology – a more technical recipient will ask about interesting details, and a person with less technological knowledge doesn’t need details at this stage. The most important thing is that every person reading the pitch deck should be able to understand how the product works and why it’s innovative. Using icons or diagrams can be helpful here to clearly explain the solution.

An interesting example of a good product description can be found in YouTube’s pitch deck.

4. Market

What is the market for this product? At what pace is it growing? What part of the market does the product have a real chance of reaching? The market context of the product/solution is the second key element of the pitch deck. It aims to estimate how wide its application can be. Of course, from the investors’ perspective, the larger or faster-growing the market, the better.

How do they assess this? Through the market size expressed in monetary terms and expected growth over the next few years (the so-called CAGR – Compound Annual Growth Rate). It has become somewhat standard to capture the market at three levels:

- Total Addressable Market (TAM): the total target market, i.e., all companies in the market that the product could reach

- Serviceable Addressable Market (SAM): the available target market, i.e., the part of the TAM market that is covered by products or services similar to the company’s solutions

- Serviceable Obtainable Market (SOM): your company’s target market, i.e., the part of the SAM market that your service or product realistically has a chance of reaching.

What’s worth providing in the pitch deck besides the above data? Their source! Lack of indicating the source of market data is a common mistake that detracts from the credibility of the message.

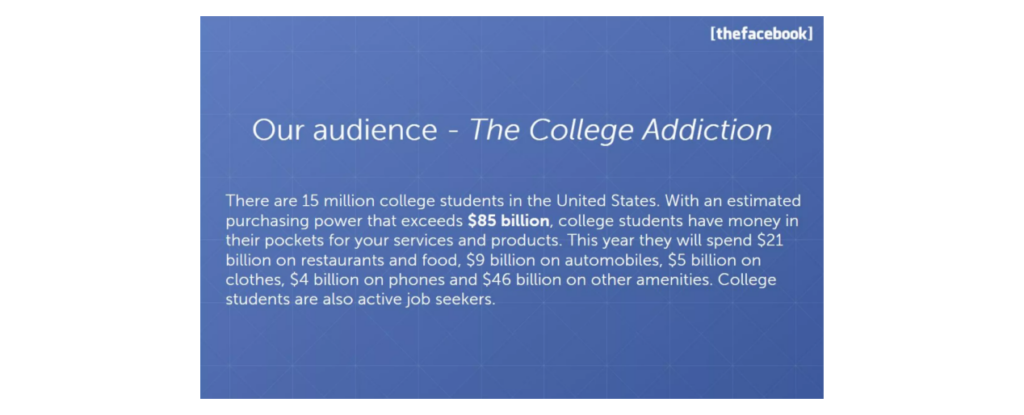

Facebook, which was initially supposed to be just a platform for students, showed very interesting data in its pitch deck regarding higher education institutions, purchasing power, and projected expenditure structure (although the source of the data was missing here).

Crunchbase also presented its target market in an interesting and convincing way. The company visually highlighted the market need for creating a single central and easy-to-use database of information about private companies.

5. Business model

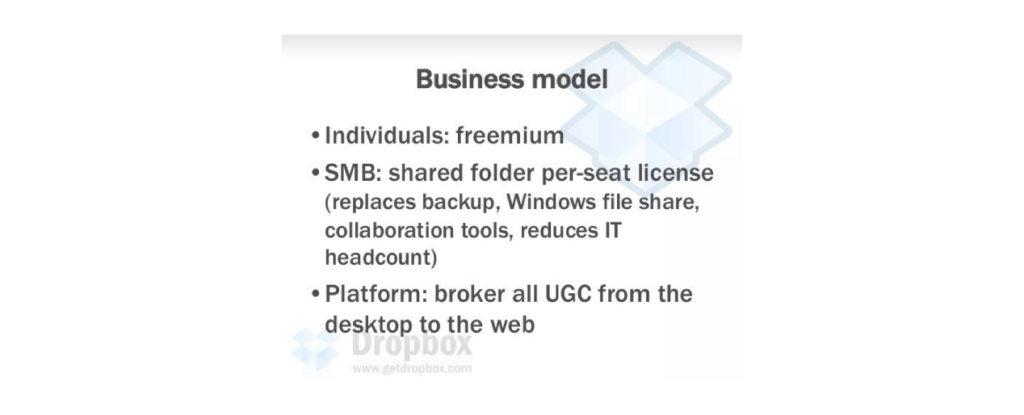

Even if your company is not yet generating income or revenue, it’s important to show in the pitch deck how it will make money in the future. Various types of schemes or diagrams illustrating market participants and the flow of services and payments between them are very helpful here. If you don’t include this point in the presentation, you can be sure that the investor will ask about it.

Dropbox in its Pitch Deck decided to use only three points and that was enough to explain how the company will make money.

6. Traction

In the venture capital environment, traction often refers to the first sale generated by a new company. In reality, this concept is somewhat broader – traction is the first market verification of the product. In many cases, it will therefore be the first sale, but also the first partnerships, letters of intent, app users, or website visits. Whatever traction your project has, be sure to describe it in the pitch deck – this way the investor will know that this solution has already generated initial interest in the market.

Often one graph is enough, for example with the number of orders growing from week to week, as DoorDash did. This is enough to convey to the audience that people are using your service and there are more and more of them.

7. Company development plans and financial forecasts

Even if you already have your first sale behind you, you’re still at an early stage of project development. Forecasting revenues for the next 3-5 years cannot be an easy task. In the case of a pitch deck, however, this exercise is necessary – the financial model will show the investor what the revenues will result from (acquired customers, product price, frequency of use) and what fixed and variable costs you will incur to obtain such revenues. A summary of these forecasts should go on a slide along with a description of the main assumptions.

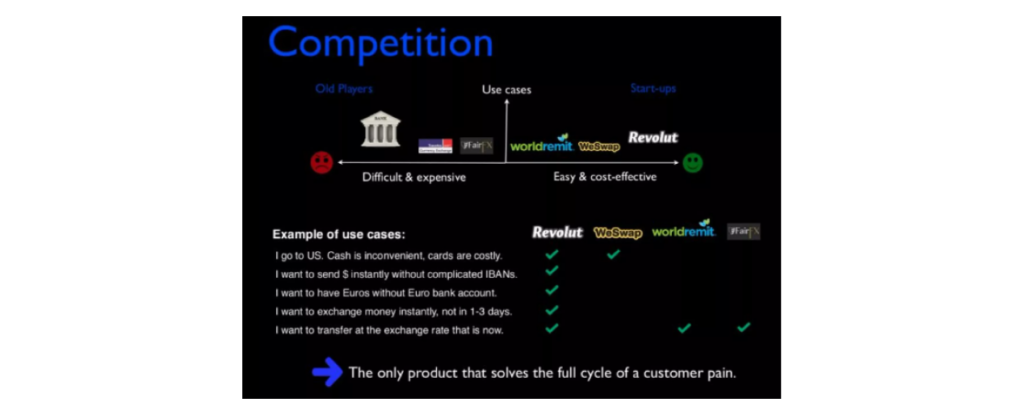

8. Competition and advantages

Every business has competition. Even if you managed to create a completely new product, you indirectly compete with someone. Indicating directly and indirectly competitive solutions in the pitch deck shows that you’ve done the necessary research and are aware of the threats, and highlighting competitive advantages – that you have a plan on how to overcome them.

When conducting your own competition analysis before making an investment decision, the fund will look at “competitiveness” broadly, just like the CEO of Netflix, who considered… sleep as a competitor to the SVOD service. So it’s worth showing investors in the pitch deck that you also see the less obvious competitors.

How to present the results of the competition analysis? The simplest way is to juxtapose similar solutions in the form of a table or, more visually, place them on a scatter plot chart with two variables – or in both these forms at once, like Revolut did.

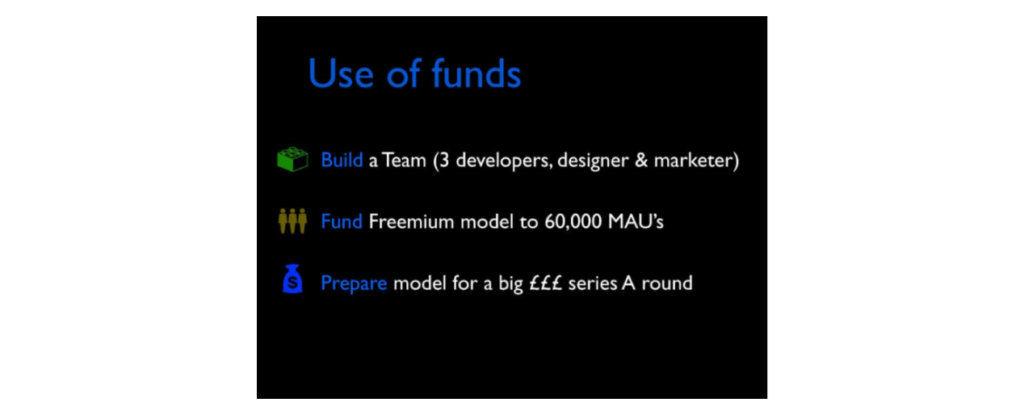

9. Capital being raised and its purpose

Like any sales pitch, an investor presentation must have its call to action. This is the moment when you lay the rest of your cards on the table. You should indicate exactly how much funds you’re raising, what you intend to spend them on, and how long the money raised in this round will last (the so-called runway).

If you already have an idea about your company’s valuation, it’s also worth mentioning it here. Similarly, if more than one fund is participating in the round and some part of the capital has already been secured. This is very valuable information, as it indicates that someone in the market has already believed in your vision, and this puts you in a completely different light in the eyes of a new investor.

An example can again be seen in Revolut’s pitch deck. The company specifically informs what amount of capital it intends to raise and what it wants to achieve with these funds.

10. Founding team

Even the best idea doesn’t guarantee success without the right team that will be able to develop it and build a profitable company. Show that you have both.

Funds invest in ideas implemented by teams of brave, inspiring people. Therefore, a slide dedicated to the founders and their competencies must appear in the pitch deck. The achievements and competencies of the founders shown in the deck should leave no doubt that the team is able to realize the presented vision.

An example is the presentation prepared by Flipkart for its future owner – Walmart.

Interesting examples of pitch decks

Where to look for inspiration when creating a pitch deck? From the best. Investor presentations of many companies are publicly available and it’s particularly worth looking at how companies that raised the most capital at high valuations handled this challenge:

- Airbnb (considered by many to be one of the best pitch decks in history)

- Uber seed round $200k

- Palau Project seed round $125k

- Syneroid Technologies Corp seed round $500k

- Momentum seed round $5m

You can find other interesting examples of Pitch Decks here and here.

Storytelling? Yes, please

Does a pitch deck necessarily have to contain all the elements described above? No. You don’t have to keep this order either – it’s enough for your chosen logic to be consistent. The most important thing is that the presentation has a coherent narrative and tells a convincing story about how the product you created will solve a real market problem and win the hearts of recipients.

***

Do you already have an excellent pitch deck and are looking for financing? Let’s talk. Write to us: contact@thcpathfinder.com.