- Pathfinder has invested PLN 1 milion in the startup Fincastly.

- Fincastly facilitates in-house financial management. It replaces CFO in micro, small and medium-sized companies.

- The software reduces the cost, time and risk associated with business decision-making and equips business managers with the reliable information they need to run their business effectively.

- It is the first and only solution on the Polish market offering such extensive integration with the tools already used by entrepreneurs.

Fincastly.com is a software that supports financial management in a comprehensive way, including budgeting and liquidity control processes in micro, small and medium-sized companies. It supports clients in running a more profitable business. The start-up was established in mid-2020 and after several months of improving the beta version it officially launched version 1.0 of the product.

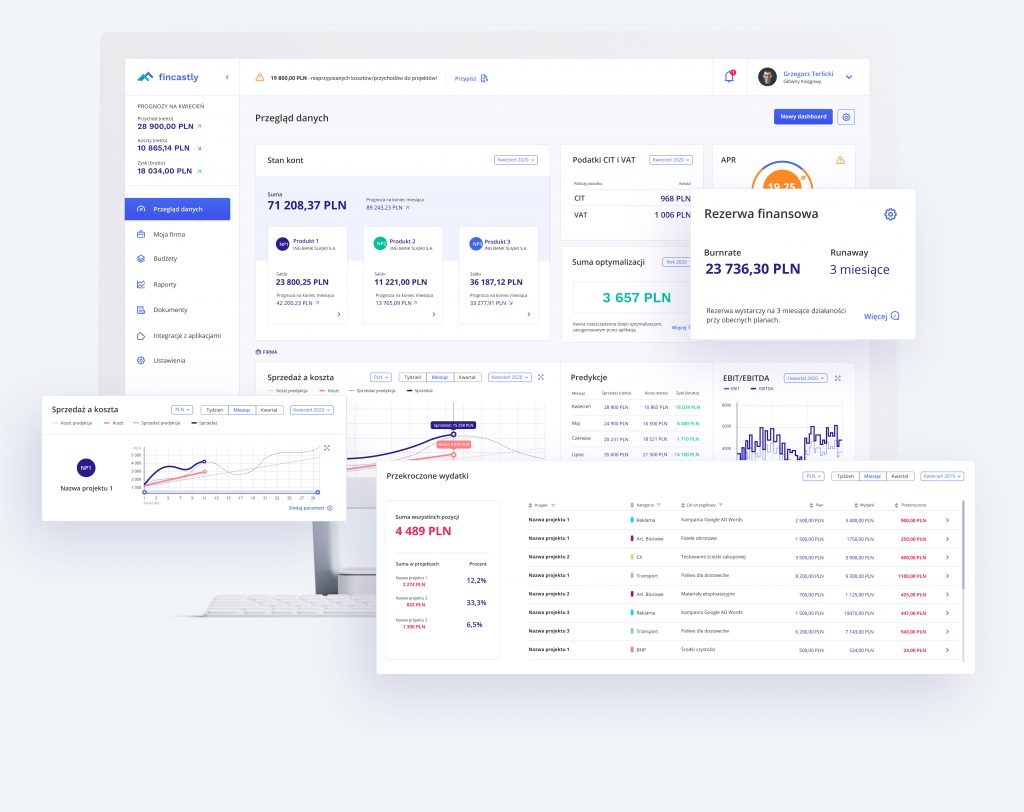

The Fincastly software reduces the cost, time and risk associated with business decision-making and equips business managers with the reliable information they need to run their business effectively. The system includes, among others, an automatically updated dashboard showing the current state of the company’s finances expressed in the most important indicators. At the heart of Fincastly are budgets that allow you to plan and track the profitability of your business activities.

The start-up also supports clients with educational activities, including “Fincastly Academy of Finance” webinars conducted on Facebook and LinkedIn platforms.

– We equip customers with always up-to-date and easy to assimilate information about the company’s finances and know-how. Not only does this allow you to run your business in a more efficient way – but also to make strategic decision-making easier and faster. Soon, the system will also be able to suggest actions optimising the company’s finances, based on best business practices. – says Bartłomiej Glac, CEO and co-founder of Fincastly.

The tool offers integrations with other popular systems such as inFakt, inFirma, SaldeoSmart, Comarch Optima, and bank accounts, thereby automating the process of data-completion within the system. The product is available in the SaaS model that avoids costly implementations.

– We are the first and only solution on the Polish market offering such extensive integration with the tools already used by entrepreneurs. Fincastly imports data directly from bank accounts so that the data available in the system is always up to date. Thanks to the PSD2 directive and the developing Open Banking approach, we are able to securely retrieve necessary banking information with customer credentials hidden from view. Data security is a key feature of Fincastly, which is why when developing new features we use only technologies that meet stringent security standards and co-operate with partners that meet the standards set by the European Union and Financial Supervision Authority (KNF), such as Microsoft as part of the Microsoft for Startups programme. – adds Jakub Sikora, the second of the founders and CTO in the company.

Fincastly’s clients are, in particular, micro, small and medium-sized companies that enter dozens of documents a month into the books and want to optimise their business, but cannot afford expensive solutions or external analytical and strategic consulting. The product is especially popular among B2B service companies, including software houses and marketing agencies.

– The economic crisis that many businesses have been facing for months is pushing their owners to look for solutions that support cost control in the company and optimise the profitability of projects. At the same time, robotic process automation (RPA) solutions are becoming increasingly popular, i.e. the technology of automating repetitive business processes using programs that simulate human work. Why spend time on something that the software will do better and faster for us? Entrepreneurs are also looking for easy-to-assimilate financial knowledge that will allow them to measure business effectively and make decisions. We give our customers both. – adds Bartosz Gayer, Fincastly co-founder, CFO and content consultant and at the same time mentor of the educational programme.

Fincastly’s development is supported by the Tar Heel Capital Pathfinder fund, which will invest the target of PLN 1 million in the company. The funds raised will be spent, among other things, on the development of AI algorithms, which will further automate the use of the software, reducing the time required to enter data and operate the system.

– A well-matched founder team is a fundamental factor we take into consideration when assessing the potential of the project. At Fincastly, we have been able to build a board whose members complement each other very well in regard to their competence, so we have confidence that the project will be run at the highest substantive level. Fincastly is a product built by taking into consideration best practices and knowledge from the worlds of finance and IT. – comments Radoslaw Czyrko, managing partner of Tar Heel Capital Pathfinder.

Fincastly acquired its first customers a few months ago, and now it is rapidly developing its user base in Poland. In the second half of the year, it plans to expand to another geographic market.